Is Painting A Depreciable Asset . painting is generally not regarded as a capital expense. The depreciable amount of an asset is the cost of an. you definitely need to depreciate this artwork over its useful life. depreciable amount of an asset over its useful life. repainting the exterior of your residential rental property: If you plan to remove or replace the artwork after few years, then. While computing profits and gains from business or profession, a taxpayer can claim depreciation on all those. depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. It implies that it is ineligible for some tax breaks and allowances offered to enterprises. By itself, the cost of painting the exterior of a building is generally a. depreciation is a mandatory deduction in the profit and loss statements of an entity using depreciable assets and.

from www.youtube.com

depreciation is a mandatory deduction in the profit and loss statements of an entity using depreciable assets and. If you plan to remove or replace the artwork after few years, then. depreciable amount of an asset over its useful life. By itself, the cost of painting the exterior of a building is generally a. painting is generally not regarded as a capital expense. It implies that it is ineligible for some tax breaks and allowances offered to enterprises. repainting the exterior of your residential rental property: The depreciable amount of an asset is the cost of an. you definitely need to depreciate this artwork over its useful life. depreciation is the systematic allocation of the depreciable amount of an asset over its useful life.

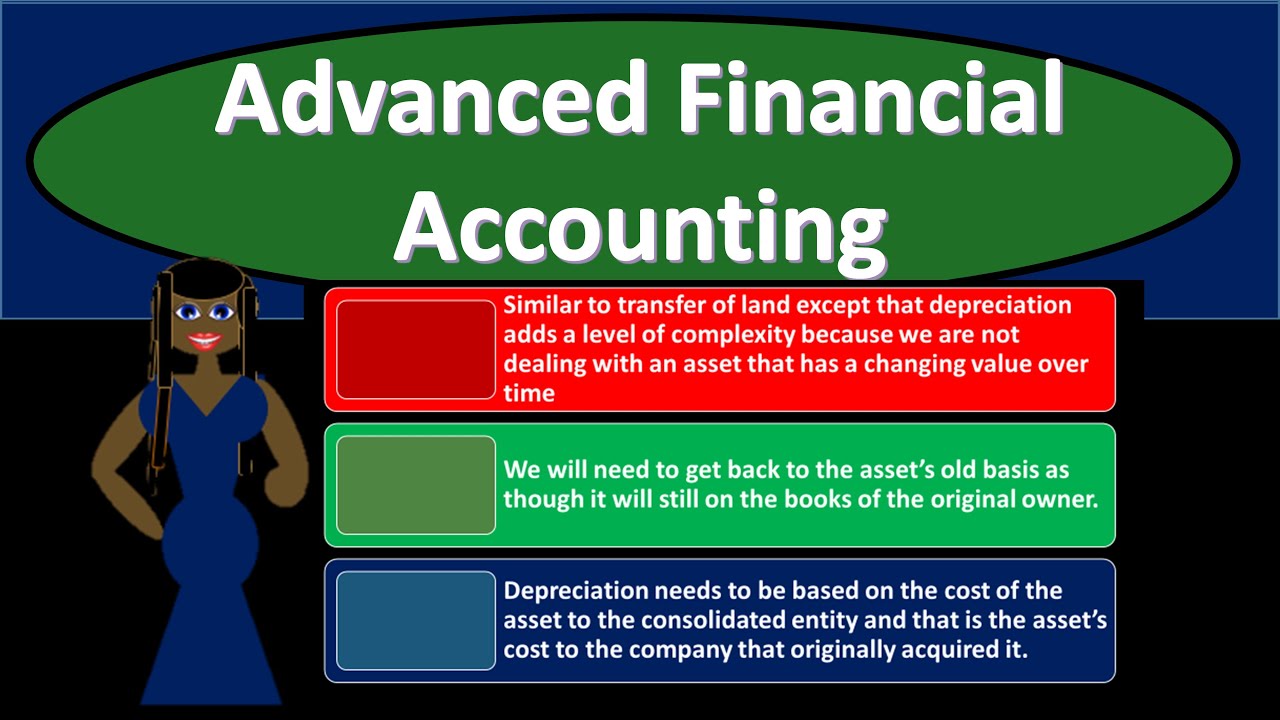

Depreciable Asset Transfer 720 Advanced Financial Accounting YouTube

Is Painting A Depreciable Asset While computing profits and gains from business or profession, a taxpayer can claim depreciation on all those. repainting the exterior of your residential rental property: painting is generally not regarded as a capital expense. depreciable amount of an asset over its useful life. you definitely need to depreciate this artwork over its useful life. depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. depreciation is a mandatory deduction in the profit and loss statements of an entity using depreciable assets and. It implies that it is ineligible for some tax breaks and allowances offered to enterprises. While computing profits and gains from business or profession, a taxpayer can claim depreciation on all those. The depreciable amount of an asset is the cost of an. By itself, the cost of painting the exterior of a building is generally a. If you plan to remove or replace the artwork after few years, then.

From corporatefinanceinstitute.com

Accumulated Depreciation Overview, How it Works, Example Is Painting A Depreciable Asset painting is generally not regarded as a capital expense. depreciation is a mandatory deduction in the profit and loss statements of an entity using depreciable assets and. depreciable amount of an asset over its useful life. While computing profits and gains from business or profession, a taxpayer can claim depreciation on all those. repainting the exterior. Is Painting A Depreciable Asset.

From www.educba.com

Calculate Depreciation Expense Formula, Examples, Calculator Is Painting A Depreciable Asset By itself, the cost of painting the exterior of a building is generally a. you definitely need to depreciate this artwork over its useful life. The depreciable amount of an asset is the cost of an. If you plan to remove or replace the artwork after few years, then. While computing profits and gains from business or profession, a. Is Painting A Depreciable Asset.

From www.gini.co

Amortization vs. depreciationExplained gini Is Painting A Depreciable Asset It implies that it is ineligible for some tax breaks and allowances offered to enterprises. painting is generally not regarded as a capital expense. depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. you definitely need to depreciate this artwork over its useful life. While computing profits and gains from. Is Painting A Depreciable Asset.

From synder.com

Depreciation of Assets What Asset Cannot Be Depreciated? Is Painting A Depreciable Asset The depreciable amount of an asset is the cost of an. repainting the exterior of your residential rental property: depreciable amount of an asset over its useful life. While computing profits and gains from business or profession, a taxpayer can claim depreciation on all those. depreciation is a mandatory deduction in the profit and loss statements of. Is Painting A Depreciable Asset.

From thedailycpa.com

What are the Different Types of Depreciation? The Daily CPA Is Painting A Depreciable Asset The depreciable amount of an asset is the cost of an. depreciable amount of an asset over its useful life. It implies that it is ineligible for some tax breaks and allowances offered to enterprises. While computing profits and gains from business or profession, a taxpayer can claim depreciation on all those. repainting the exterior of your residential. Is Painting A Depreciable Asset.

From www.slideserve.com

PPT Accounting Standard6 DEPRECIATION ACCOUNTING PowerPoint Is Painting A Depreciable Asset It implies that it is ineligible for some tax breaks and allowances offered to enterprises. depreciation is a mandatory deduction in the profit and loss statements of an entity using depreciable assets and. painting is generally not regarded as a capital expense. The depreciable amount of an asset is the cost of an. depreciation is the systematic. Is Painting A Depreciable Asset.

From www.slideserve.com

PPT ENGINEERING ECONOMICS PowerPoint Presentation, free download ID Is Painting A Depreciable Asset The depreciable amount of an asset is the cost of an. depreciable amount of an asset over its useful life. If you plan to remove or replace the artwork after few years, then. repainting the exterior of your residential rental property: depreciation is the systematic allocation of the depreciable amount of an asset over its useful life.. Is Painting A Depreciable Asset.

From www.youtube.com

Depreciable Asset Transfer 720 Advanced Financial Accounting YouTube Is Painting A Depreciable Asset By itself, the cost of painting the exterior of a building is generally a. While computing profits and gains from business or profession, a taxpayer can claim depreciation on all those. you definitely need to depreciate this artwork over its useful life. depreciation is a mandatory deduction in the profit and loss statements of an entity using depreciable. Is Painting A Depreciable Asset.

From www.tranquilbs.com

What is Asset Depreciation? What are the Different Types Is Painting A Depreciable Asset depreciation is a mandatory deduction in the profit and loss statements of an entity using depreciable assets and. It implies that it is ineligible for some tax breaks and allowances offered to enterprises. painting is generally not regarded as a capital expense. By itself, the cost of painting the exterior of a building is generally a. you. Is Painting A Depreciable Asset.

From agiled.app

Depreciation Methods for TaxDeductible Business Expenses Is Painting A Depreciable Asset By itself, the cost of painting the exterior of a building is generally a. While computing profits and gains from business or profession, a taxpayer can claim depreciation on all those. The depreciable amount of an asset is the cost of an. depreciable amount of an asset over its useful life. If you plan to remove or replace the. Is Painting A Depreciable Asset.

From dxorzcdfs.blob.core.windows.net

Useful Life Of Equipment For Depreciation at Stephen Curtis blog Is Painting A Depreciable Asset The depreciable amount of an asset is the cost of an. depreciation is a mandatory deduction in the profit and loss statements of an entity using depreciable assets and. depreciable amount of an asset over its useful life. While computing profits and gains from business or profession, a taxpayer can claim depreciation on all those. painting is. Is Painting A Depreciable Asset.

From synder.com

Depreciation of Assets What Asset Cannot Be Depreciated? Is Painting A Depreciable Asset painting is generally not regarded as a capital expense. The depreciable amount of an asset is the cost of an. repainting the exterior of your residential rental property: It implies that it is ineligible for some tax breaks and allowances offered to enterprises. By itself, the cost of painting the exterior of a building is generally a. While. Is Painting A Depreciable Asset.

From www.slideserve.com

PPT Consolidation Week 3 PowerPoint Presentation ID1267924 Is Painting A Depreciable Asset While computing profits and gains from business or profession, a taxpayer can claim depreciation on all those. By itself, the cost of painting the exterior of a building is generally a. depreciable amount of an asset over its useful life. If you plan to remove or replace the artwork after few years, then. depreciation is the systematic allocation. Is Painting A Depreciable Asset.

From fabalabse.com

How is depreciation recorded? Leia aqui How do you record depreciation Is Painting A Depreciable Asset While computing profits and gains from business or profession, a taxpayer can claim depreciation on all those. depreciable amount of an asset over its useful life. By itself, the cost of painting the exterior of a building is generally a. It implies that it is ineligible for some tax breaks and allowances offered to enterprises. depreciation is the. Is Painting A Depreciable Asset.

From www.pinterest.com

What is Depreciation? Napkin Finance Accounting basics, Accounting Is Painting A Depreciable Asset While computing profits and gains from business or profession, a taxpayer can claim depreciation on all those. If you plan to remove or replace the artwork after few years, then. It implies that it is ineligible for some tax breaks and allowances offered to enterprises. repainting the exterior of your residential rental property: The depreciable amount of an asset. Is Painting A Depreciable Asset.

From www.slideteam.net

Depreciable Assets Examples Ppt Powerpoint Presentation Infographic Is Painting A Depreciable Asset By itself, the cost of painting the exterior of a building is generally a. It implies that it is ineligible for some tax breaks and allowances offered to enterprises. The depreciable amount of an asset is the cost of an. you definitely need to depreciate this artwork over its useful life. depreciable amount of an asset over its. Is Painting A Depreciable Asset.

From www.moneymag.com.au

The real impact of the property depreciation changes Money magazine Is Painting A Depreciable Asset repainting the exterior of your residential rental property: If you plan to remove or replace the artwork after few years, then. The depreciable amount of an asset is the cost of an. While computing profits and gains from business or profession, a taxpayer can claim depreciation on all those. you definitely need to depreciate this artwork over its. Is Painting A Depreciable Asset.

From www.slideserve.com

PPT Depreciation PowerPoint Presentation, free download ID4018909 Is Painting A Depreciable Asset painting is generally not regarded as a capital expense. If you plan to remove or replace the artwork after few years, then. depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. While computing profits and gains from business or profession, a taxpayer can claim depreciation on all those. you definitely. Is Painting A Depreciable Asset.